Financial Peace of Mind

Picked Just for You

Get $150 With Visa Signature

Mortgage

Profit Payout*

Investing in YOU by sharing our profits.

As a not-for-profit credit union, we return our profit to those who bank with us in many ways – like better rates, lower fees, and our Profit Payout. See how much you may be able to earn through our long-standing annual give-back, where we’ve returned $93 million to members over the past 12 years.

Hear From Our Members

This bank is awesome

This bank is awesome. You'll always be welcomed by staff no matter how busy it is. Laid back establishment but quick transactions. Always warm cookies and coffee.

I love it here so much!

I go through this bank, and made my boyfriend go get his first bank card/account. The workers here are AMAZING. Extremely respectful, helpful, sweet, full of character. I love it here so much! Thank you guys for being amazing!

Love this bank

Great staff, love this bank. Way better than any large bank in the area.

10/5 Stars

Angel was absolutely amazing! Very kind and helpful with a car loan, and got me approved when I was certain I wasn't going to get it. 10/5 stars.

Check Out Our Great Rates

See All Rates

Your Banking Wingman

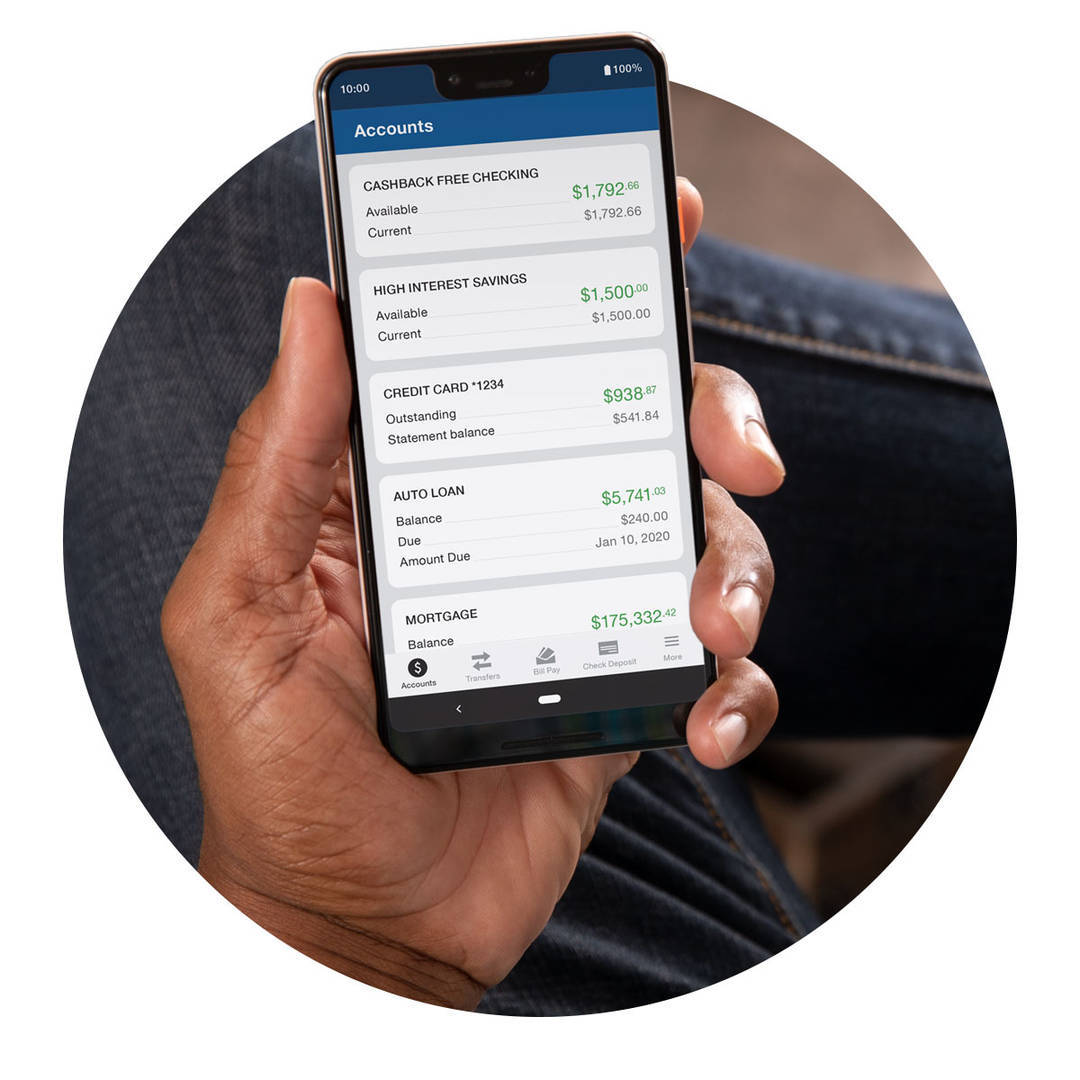

Check out our highly rated Mobile App.

When it comes to our Mobile App, we’ll admit we’re a bit biased. After all, we worked hard to make it possible to do just about everything you can in a branch right from your smartphone. But tens of thousands of Kansas Citians have made their voices heard, too. The results? Near-perfect ratings on both the App Store® and Google Play™. The feeling of love is mutual, KC.From the Blog

Saving vs. Investing: What’s the Difference?

Protect Your Money When Using Payment Apps