System Upgrade

We strive to work hard to make sure your banking experience with us is exceptional. That was especially the case with our System Upgrade that took place over Labor Day weekend. On the surface, members won’t notice a lot of differences. But the inner workings of the Credit Union saw substantial changes, allowing us to improve our service; offer enhanced products and digital services; and provide innovations in the future. To better understand what took place during the Upgrade Period, please review the following information.

System Upgrade Overview

What to Expect After the System Upgrade

Key Things to Know About the Upgrade

Online Banking Changes & Tips

There are a few things that might look a little different when you look at your accounts. Below is a list of things that you might notice:- Accounts display in a different order than what was previously there. To reorder your accounts, simply log in to the desktop version of Online Banking, then click on “My Settings.”

- Hidden accounts may be visible again – don’t fret! To re-hide any accounts, easily log in to the desktop version of Online Banking, then click on “My Settings.”

- The last 4 digits of accounts numbers may display differently. Rest assured, your account number is still the same and you don’t have to do anything to adjust.

- Some account nicknames in Online Banking didn’t transfer properly. You can update this by logging in to the desktop version of Online Banking, then click on “My Settings.”

- We do apologize for this as we recognize there may be some confusion.

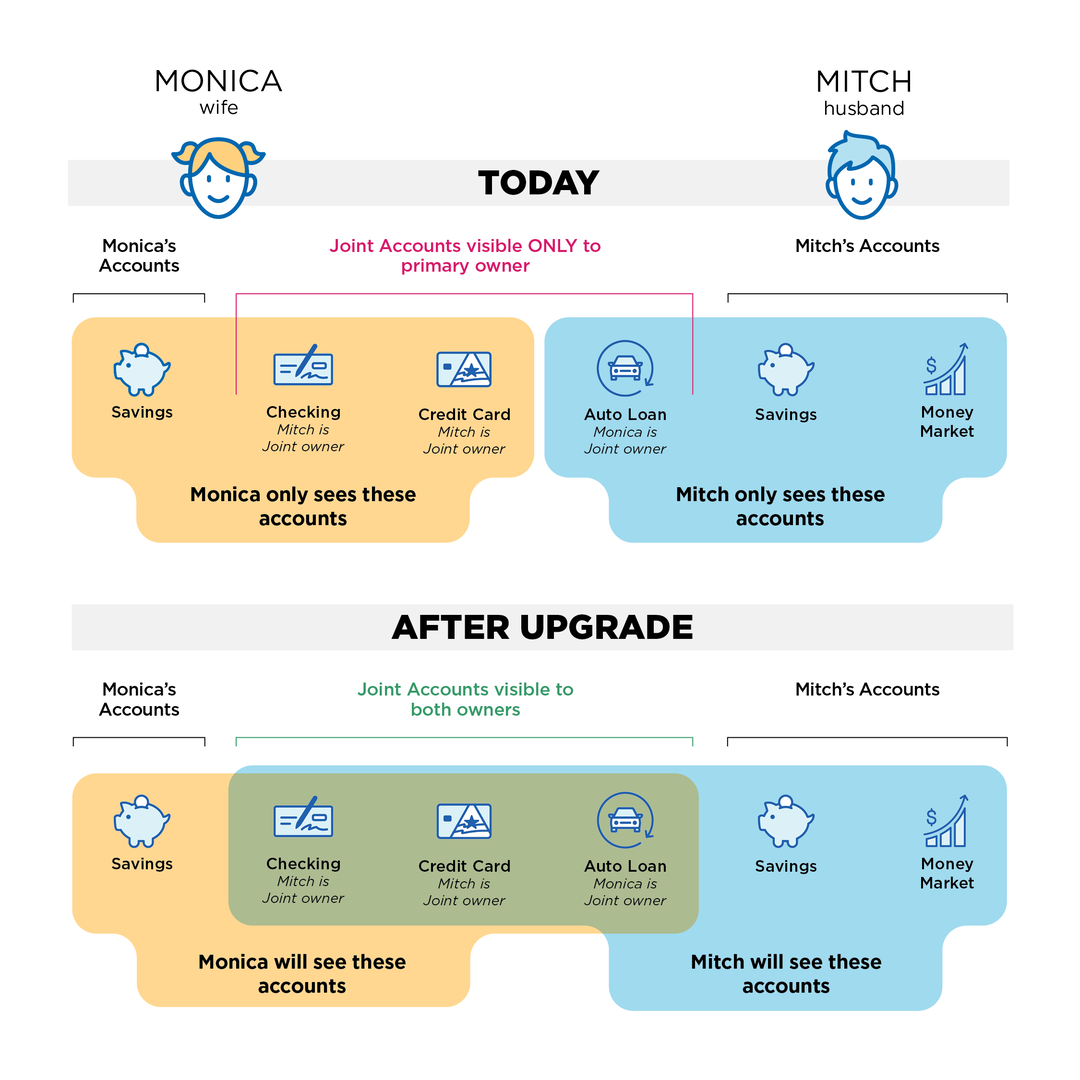

Viewing Joint Accounts

- Managing all your accounts will be much easier! Any accounts you’re considered an owner of – including joint accounts – will be visible in Online Banking and Mobile App. Anyone who is a joint account owner will be able to view the account in their own Online Banking and Mobile App login. If you need to change the joint owners on your account(s), please call 913.905.7000, or visit a branch before Friday, September 2 to ensure the correct people are associated with each account. You will still be able to make changes if you find that you need to after the Upgrade Period.

- All transactional accounts will now be visible under one member number. This means that all accounts that are associated with your member number and/or social security number – including joint accounts - will be visible on Online Banking and Mobile App. Anyone who is associated with your transactional account will be able to view it on their personal Online Banking and Mobile App login.

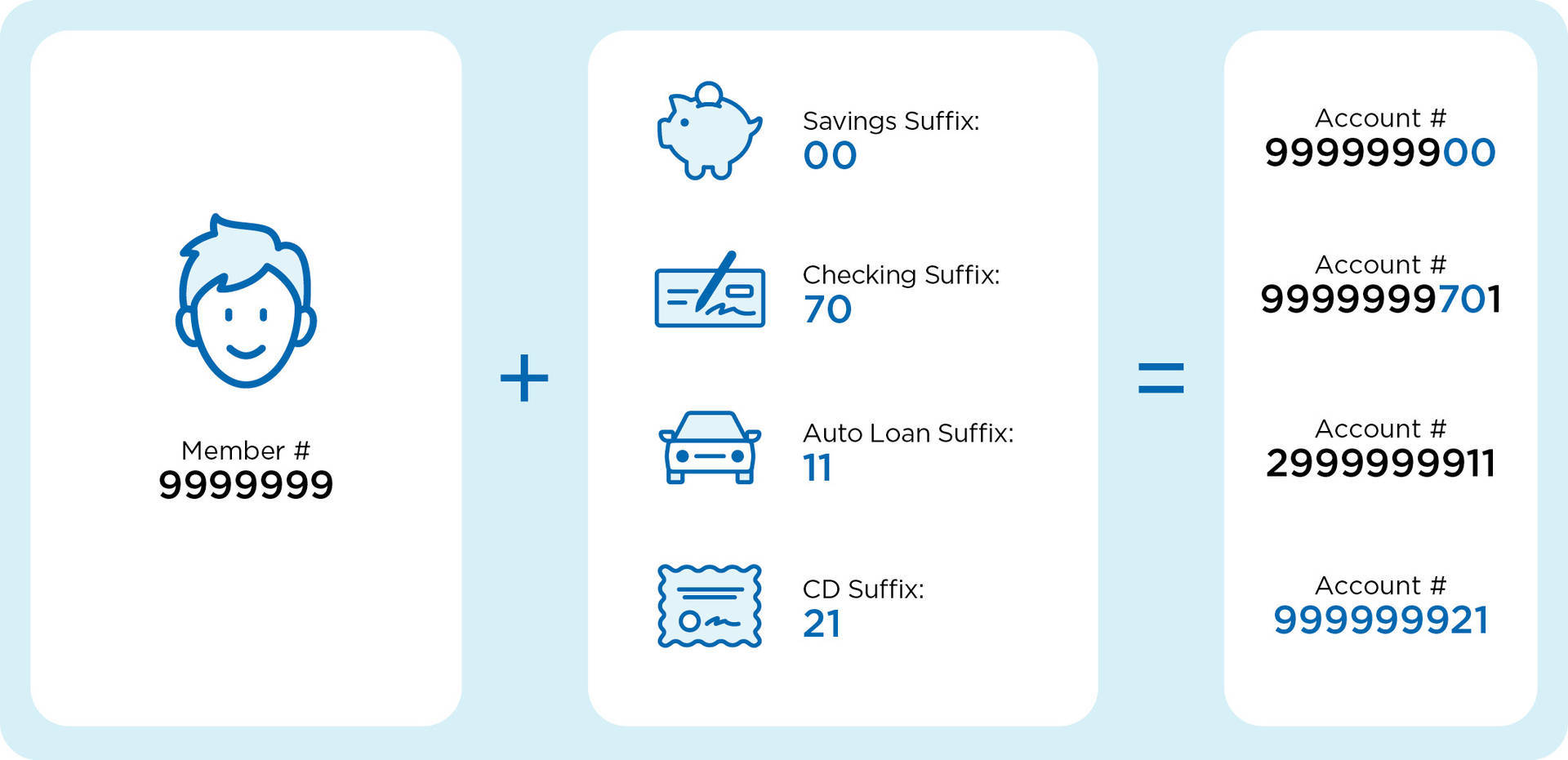

- Account numbers will stay the same with small modifications. Going forward, your member number will be combined with the product-type suffix to create an account number for each of your accounts. While this will look a little different in Online Banking and the Mobile App, you won’t have to do anything additional to your accounts and everything will function as it does today.

- Debit cards, credit cards, and checks, which will all function as usual (no need for replacements)

- Automatic payments (ACH), direct deposits, and scheduled transfers; these will continue to post with no changes required

- Online Banking and Mobile Banking username and passwords

- PINs for debit cards, credit cards, ATM cards, and Automated Phone Banking

- CommunityAmerica consumer routing number (301081508)

- Account nicknames in Online Banking

- You’ll use the same Mobile App.

Impact of the Upgrade Period

What to Expect During the Upgrade Period

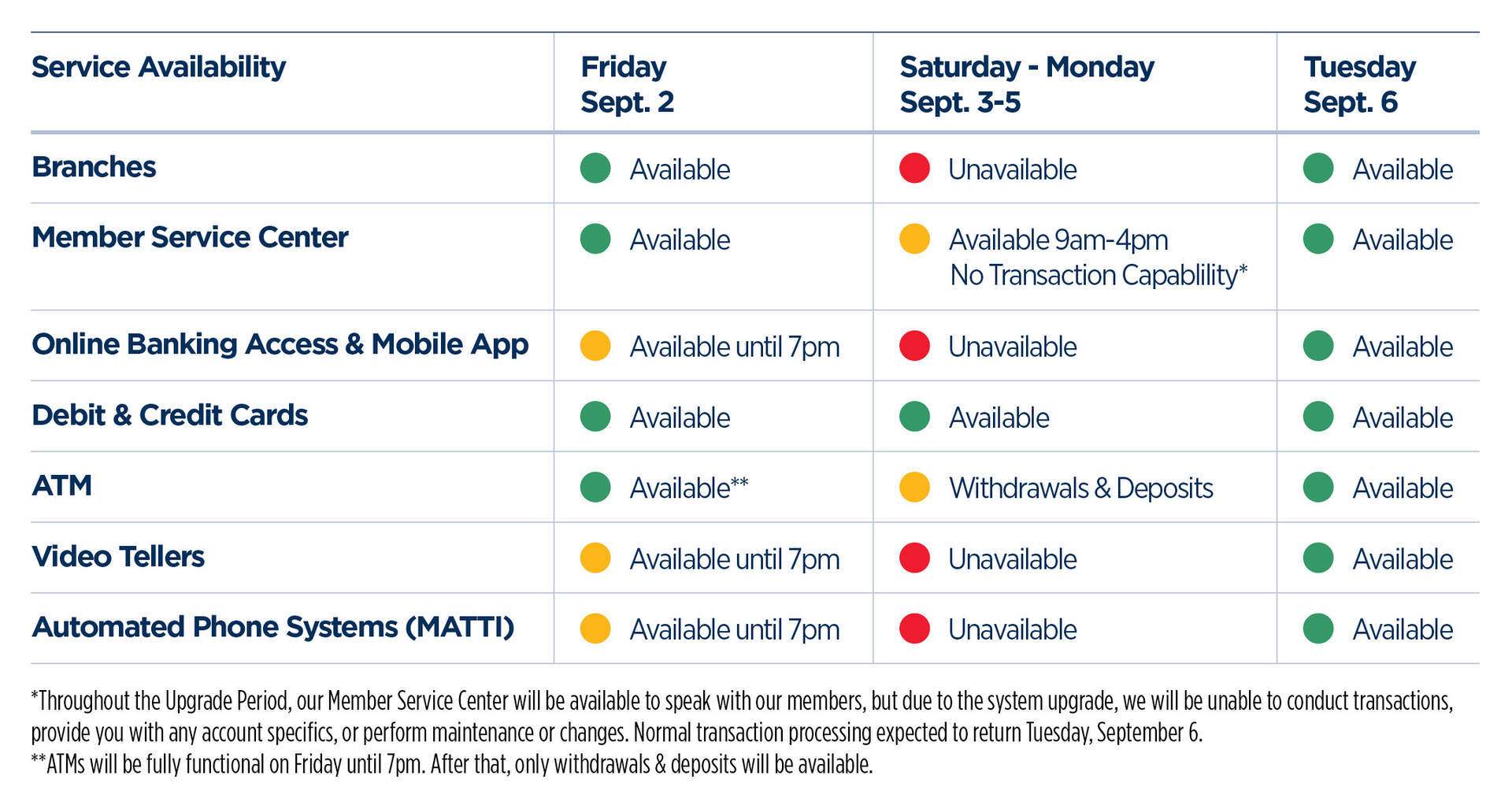

The time in which we will be doing the actual System Upgrade will be referred to as the Upgrade Period. During the Upgrade Period, we expect your banking experience to be very similar to how it is today, but there will be a brief downtime that may affect you.

Debit and credit cards continued to work during the Upgrade Period, but members could not access Online Banking or the Mobile App. Online Banking and Mobile App were unavailable beginning Friday, September 2, 2022 at 7pm CT and became available again on Tuesday, September 6. Your accounts should show your updated transactions from the weekend within 24 hours.

How to Prepare for the Upgrade Period

How to Prepare

Mark Your Calendar: September 2-5

- Branches will be open normal hours on Friday, September 2 (hours vary by location), closed Saturday, September 3, through Monday, September 5. They will resume normal hours on Tuesday, September 6. You will not be able to login to Online Banking or Mobile App during this time.

Review Your Contact Information

- Please make sure your contact information is updated, including mailing address, email, and phone number, so you don’t miss out on any important notices or messages. Log in to Online Banking or Mobile App to update your information today.

Schedule Online Bill Payments and Transfers in Advance

- One-time Online Bill Pay and External Transfers will be unavailable after 5pm on Thursday, September 1, until Tuesday, September 6.

- Payments previously scheduled will process as planned.

Review Account Ownership

- Make sure the desired joint owner(s) are listed for each account. You can review your joint owners on your account statements, on paper or through E-Statements in Online Banking. Joint owners will be able to view the account in Online Banking and Mobile App beginning Tuesday, September 6.

- To change or update a joint owner, please call us at 913.905.7000, or visit a branch before Friday, September 2. These can still be updated after the Upgrade.

Plan Ahead for your Labor Day Weekend Spending

- Since you won’t have access to your balances beginning at 7pm Friday, September 2, we recommend checking your account balance(s) ahead of time so you have the most up-to-date information for your weekend and can more easily keep track of your spending throughout Labor Day weekend.

- If you aggregate your CommunityAmerica account data into other software, such as Quicken, please note that aggregation services from CommunityAmerica accounts will be interrupted during our system Upgrade Period and up to five business days afterward. We recommend that you download your updated information on Thursday, September 1, then track your transactions until the connection resumes.