Earn 3.60% APY1 on our 3-Month or 7-Month Certificate

Open AccountFinancial Peace of Mind

At CommunityAmerica, we’re invested in the financial well-being of our members and our community. It’s this commitment that drives us to share profits with our members, offer competitive rates and low fees, create long-term partnerships with local businesses, and support local nonprofit organizations making an impact in our area. As your truly local credit union, we are proud to be your trusted banking partner.

Picked Just for You

Profit Payout*

We're Invested In YOU

As a member of our not-for-profit credit union, you're not just banking with us. You're earning with us. We reward those who bank with us in many ways - through competitive rates, low fees, and our annual Profit Payout. We've shared $110 million with our members over the past 14 years.

Check Out Our Great Rates

Your Banking Wingman

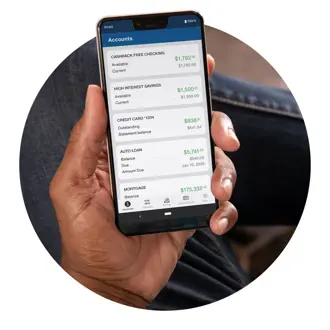

Check out our highly rated Mobile App.

When it comes to our Mobile App, we’ll admit we’re a bit biased. After all, we worked hard to make it possible to do just about everything you can in a branch right from your smartphone. But tens of thousands of members have made their voices heard, too. The results? Near-perfect ratings on both the App Store® and Google Play™. The feeling of love is mutual.