High-Yield, High-Access

Earn 3.25% APY* and easy access to your funds with our Advantage Money Market.

Financial Peace of Mind

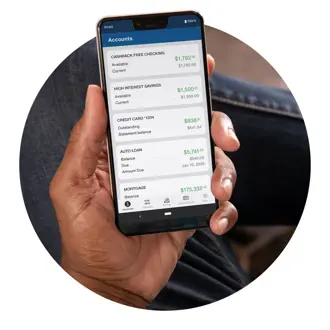

At CommunityAmerica, we’re invested in the financial well-being of our members and our community. It’s this commitment that drives us to share profits with our members, offer competitive rates and low fees, create long-term partnerships with local businesses, and support local nonprofit organizations making an impact in our area. As your truly local credit union, we are proud to be your trusted banking partner.

Picked Just for You

Profit Payout*

Investing in YOU by sharing our profits.

As a not-for-profit credit union, we return our profit to those who bank with us in many ways – like competitive rates, low fees, and our annual Profit Payout. See how much you may be able to earn through our long-standing annual give-back, where we’ve returned $100 million to members over the past 13 years.

Check Out Our Great Rates